How the Founder of Liquid Death Built a $700 Million Water Brand

Let’s face it: water is boring.

Sure, it’s vital to your health, and few beverages are more crisp or refreshing, but most bottled water brands are pretty bland—identical to the same interchangeable versions of mountain spring water, purified water, or both. Characteristics.

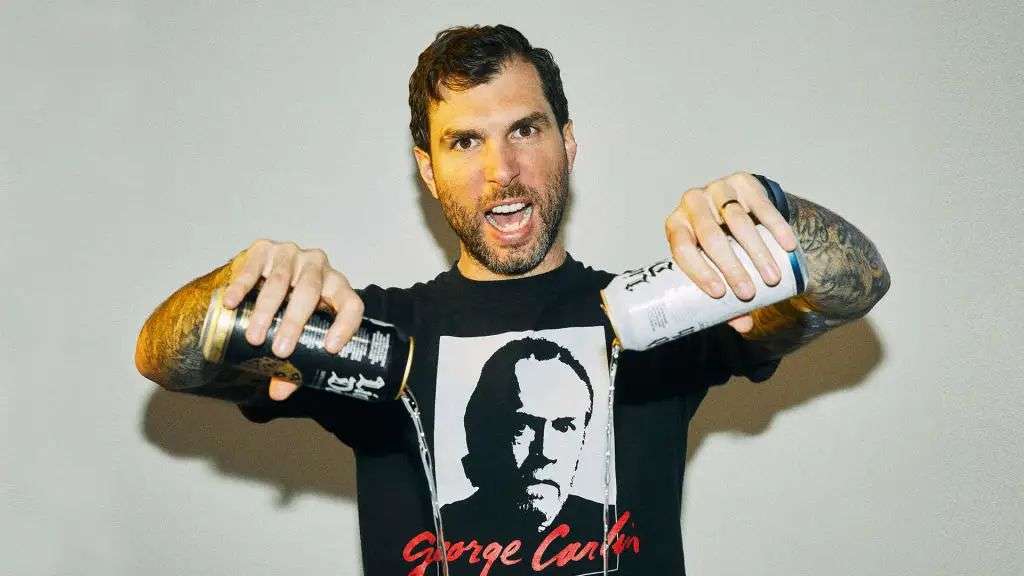

More than a decade ago, Mike Cesario began wondering if he could change that. What if he could actually make the water cooler?

Such is the relatively simple entrepreneurial story behind Liquid Death, the ironically named canned water brand that Cesario trademarked in 2017 and officially launched two years later. It might seem like a joke at first, and it is, but there’s nothing funny or boring about how quickly Liquid Death has become a dominant force in the $350 billion global bottled water market.

From viral social media posts to Super Bowl ads, Liquid Death suddenly seems to be everywhere—along with its cheeky (and a little too campy) slogan, “Murder Your Thirst.” That social cachet is reflected in a jump in its sales, which stood at $2.8 million in 2019 and are expected to reach $170 million in 2024.

“I didn’t expect it would develop so fast.”

Cesario, a marketing professional with a background in design and underground music, said he initially thought his water brand would only have a small following.

“I didn’t expect Liquid Death to grow as fast as it did,” said Cesario, 40. “I think the most surprising thing for everyone is how broad the audience is.”

Cesario expects the idea to be popular with underground rock musicians, singers looking to stay hydrated during long gigs, and fans looking to stay awake while drinking something healthier than alcohol or sugary energy.

Instead, it has found a broader fan base, from young people who like the brand’s “cool” name and design to moms who want their kids to drink healthy drinks. Liquid Death packages its “mountain water” in 16.9-fluid-ounce “tall bucket” cans emblazoned with a melted skull logo that’s reminiscent of craft beers or energy drinks like Monster and Rockstar.

Also attracting attention are deep-pocketed investors such as Live Nation Entertainment, and celebrity backers such as comedian Whitney Cummings and members of the music group Swedish House Mafia. In total, Cesario said investors have poured about $195 million into Liquid Death, valuing the brand at $700 million.

Liquid Death’s meteoric rise in just three years has made the company more than just a clever name – although Cesario admits that may be his product’s biggest selling point.

“At the end of the day, we’re really creating an entertainment company and a canned water company,” he said. “We want to really entertain people and make them laugh and serve the brand. If you can do that, they’re going to love your brand because you’re giving them something of value.”

Inspiration for the banter tour

The seeds of the idea were planted in 2009, Cesario said.

He was living in Denver at the time and watching some friends and their bands perform at the Vans Warped Tour music festival. He said Monster Energy Drink was a sponsor of the tour, so the musicians drank from Monster cans, but they replaced the energy drink with water to stay hydrated during the show.

“It started me thinking: Why aren’t there more wellness products that still have fun, cool, rebellious brands?” Cesario said. “Because most of the most interesting, memorable, and rebellious brand marketing is for junk food.”

Then, in 2014, Cesario was working on a public service announcement campaign about the health risks of sugary energy drinks. The idea, he said, was to “make canned water, in a way, just to poke fun at the general energy drink gimmick that’s out there.”

The client didn’t like it, but Cesario kept tinkering with the concept in his free time. “It took about two years to hone the concept and, most importantly, settle on a name.”

Liquid death must be “very interesting” to survive.

Cesario knew that if he launched his own water brand, he wouldn’t have the funds to market it to the masses the traditional way.

That means the name and brand image need to be the perfect blend of fun, edgy, and cool—memorable enough to generate buzz, get people sharing the conversation on social media, and create free advertising traffic.

“The only way the brand has a chance of survival is if the actual product itself has to be so interesting that so much of the marketing goes into the product,” he said.

So Cesario turned to a marketing technique he says his Liquid Death team still uses today: What’s the dumbest idea ever? He explains that if you try to come up with a smart idea, your brain will naturally think about successful examples that already exist.

“You have to trick your brain into coming up with a bad idea to actually think in the innovation space,” he said. “It works really well because you start thinking, ‘Oh, what’s the stupidest name for a super healthy, safest drink? Liquid Death. Probably the stupidest name.”

When Cessario trademarked the name in 2017, he felt like he had to be on to something in this space.

“If someone I knew saw this in a store, I’m pretty sure they would pick it up and ask, ‘What is this?'” he said. “Once someone picks up your product, you basically win.”

One person on social media asked: “Is this true?”

As a consumer product that comes out of pure online channels, fans of Liquid Death have doubts about the authenticity of this brand.

Cesario hopes Liquid Death will generate its own marketing, but he still needs funding to turn it into a real consumer product that can be sold.

Initially, he was told by potential investors and beverage industry figures that the design of the Liquid Death canned water looked too much like beer, which might confuse customers, and that “retailers would never put something on the shelf that said ‘Death'” ‘Something,’ he said.

To prove that Liquid Death was a viable brand, Cesario made 3D renderings of his canned water product designs and created a Facebook page in 2018 to make Liquid Death look like a legitimate product. He shot a two-minute spot starring his wife’s actress friend, which cost him $1,500, and used his own savings to spend “a few thousand dollars more in paid media” to promote it.

Four months later, the video has been viewed 3 million times and the Facebook page has nearly 80,000 followers. and received hundreds of messages and comments from people. Apparently this video and the strange canned stuff in it aroused everyone’s interest.

People contacted the Facebook page asking where they could buy Liquid Death. Cesario said they were contacted by beverage distributors looking for salespeople so they could stock their stores.

The reaction was swift enough for investors.

After two years of pitching the idea to potential backers, Cesario secured $1.6 million in seed funding from Science Ventures in January 2019. That same month, Liquid Death began selling canned water to customers through its website.

How long can this “joke” last?

Today, Liquid Death has more than 250,000 followers on Facebook and 1.4 million followers on Instagram.

In 2020, the brand expanded into Whole Foods stores and did about $10 million in sales that year. Last year, that number jumped to $45 million with the addition of chains like 7-Eleven and Publix.

Earlier this year, Liquid Death launched a line of flavored carbonated waters that still retain a certain irreverence with names like “Berry It Alive” and “Severed Lime.”

The brand is now sold at more than 60,000 retail locations across the country, including Kroger and Target, with each can retailing for $1.89. Liquid Death is the best-selling still water brand and the second-best selling sparkling water brand on Amazon.

Cesario said Liquid Death “definitely” expects to double its revenue next year, with sales expected to reach about $260 million in 2023. But how far can a canned water brand based on banter and jokes go?

Many of the largest bottled water brands are owned by large conglomerates, such as Coca-Cola, which owns Dasani and Smartwater, and PepsiCo, which owns Aquafina. Any one of them could launch their own brand of rebellious water, but Cesario seems unconcerned by the prospect of having a tree behind him.

·END·

our address

A2903, Yake Center, Puyan Street, Binjiang District, Hangzhou, China

our PHONE

+86-15709611832